By: TSheets

Are employees required to file multiple state tax returns for working in another state?

The Mobile Workforce State Income Tax Simplification Act

Congress has recently been ruminating on the Mobile Workforce State Income Tax Simplification Act.

If passed, the Act would prevent individual states from taxing nonresidents who work in their state for less than 30 days within a calendar year:

“No part of the wages or other remuneration earned by an employee who performs employment duties in more than one State shall be subject to income tax in any State other than the State of the employee’s residence; and the State within which the employee is present and performing employment duties for more than 30 days during the calendar year in which the wages or other remuneration is earned.”

In other words, state income tax laws would no longer apply to mobile workers until those workers have spent more than 30 days working in that state over the course of 12 months.

How will the Simplification Act affect mobile employees?

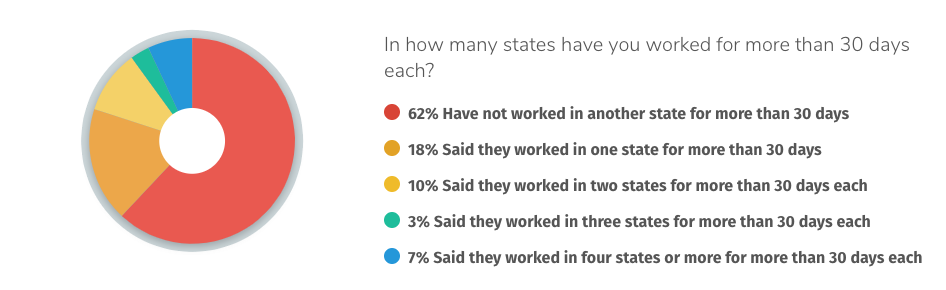

TSheets’ study found more than one-third of employees who worked out-of-state within the past 12 months spent more than 30 days in the state, or states, they worked in. In fact, 7 percent of those employees were said to have worked in four or more states for more than 30 days each.

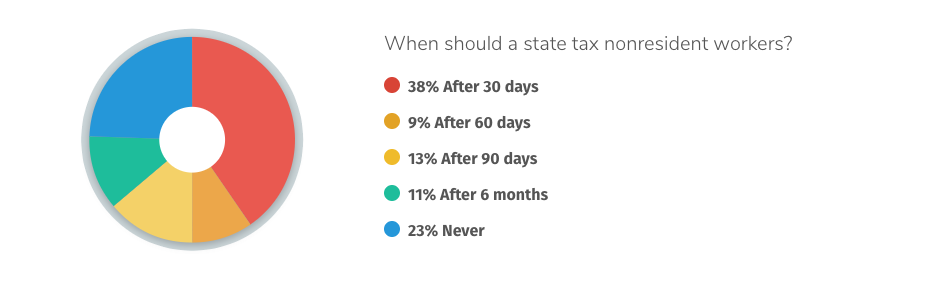

According to the survey, approximately 1 in 4 U.S. employees believe states should never tax nonresident workers. Another 1 in 3 thinks the grace period should be longer — up to six months. What’s more, 7 percent of respondents agree that having to pay additional state income taxes actually discourages them from working out of state.

How can you ensure you and your mobile employees are complying with state income tax requirements?

As always, knowledge is power. It’s important for you and your employees to know exactly how much time they’re spending on the clock, especially while they’re traveling for work.

If the Tax Simplification Act passes, your employees will be responsible for tracking the hours and days they spend working in other states — that is, unless you, the employer, has a time and attendance system “that tracks where the employee performs duties on a daily basis.”

Requiring your employees to track their own time using paper time cards or spreadsheets leaves your company and your employees vulnerable to inaccurate data and guesstimation. Those are two words you want to avoid when it comes to paying taxes.

Invest in an automated time tracking software (like TSheets) that allows your employees to quickly and easily track their hours worked both in the office and out on the road. And with GPS location tracking built in, you can rest easy knowing you and your employees are covered come tax time.

Check out the complete, interactive state-by-state guide here.

1Methodology: TSheets surveyed 811 U.S. workers on August 8, 2017, about their work-travel habits. The sample was selected by Pollfish. A quarter of the respondents were self-employed and the rest were employed for wages. Any respondents who had not traveled to another state for work in the previous 12 months were screened out after the first question. This left 502 people to complete the remaining 13 questions.

2 Please refer to a professional HR, legal, or financial advisor regarding specific requirements about state income tax laws and how they impact your employees. TSheets does not recommend particular practices and leaves those decisions to the discretion of your organization.

3 It’s important to keep in mind that some states don’t charge income tax, and others have reciprocal arrangements in place to prevent double-taxation of mobile workers.

Published by Conselium Executive Search, the global leader in compliance search.